Cost Report Filing

Medicare cost reports are required to be filed each year. A cost report normally covers a 12-month period and must be submitted within five months of the end of provider’s cost reporting period.

Filing the cost report before the due date is strongly recommended, as:

- Filing late — results in payments being suspended

- Filing early — establishes a grace period in the event the report is rejected, allowing time to correct and resubmit the report before payments are suspended

Please note that filing a cost report even a few days late, can result in an extended period of suspended payments. Suspended payments are not released until the cost report is received and determined to be acceptable. In busy periods (such as the month of June), it may take 30 days to accept the cost report.

Obtain Access to MCReF

The Medicare Cost Report e-Filing (MCReF) system is provided by the Centers for Medicare & Medicaid Services (CMS) to simplify the process of submitting a Medicare Cost Report. MCReF is a secure portal for the transmission of documents (including PII/PHI). Files uploaded are not to be encrypted or password protected. Benefits of using MCReF:

- Electronic signature is accepted

- Postage expense is eliminated

- PHI is secure

- Confirmation of receipt is received immediately

See Medicare Cost Report e-Filing (MCReF) for information about MCReF, plus how to access and use the system. This includes a video overview and a detailed user manual.

Obtain PS&R Report

Providers are required to obtain their own PS&R report(s) for use in preparing the cost report. Please refer to the following articles for instructions on accessing the system and ordering reports.

Standard Templates

To streamline the Medicare Cost Report process, CMS provided electronic versions of key cost report exhibits. By using the CMS provided (optional) version of the exhibits — there should be a reduced need for follow-up communication regarding the cost report submission. Additionally, when filing using MCReF, a provider will receive pre-emptive feedback about potential issues with their exhibits.

Click Electronic Cost Report Exhibit Templates to view the entire article in CMS.gov. This section provides information about the exhibits and the “Downloads” section contains exhibits/templates in an Excel file and specifications/directions in a PDF file. A direct link to each exhibit/template is included below.

Hospital Cost Reports (2552-10)

For cost reporting periods beginning on or after October 1, 2022, hospital cost reports must be filed with listings that support Medicaid Eligible Days (Exhibit 3A), Medicare Bad Debts (Exhibit 2A), Charity Care (Exhibit 3B), and Total Bad Debts (Exhibit 3C). For a description of each template, please review: Standard Templates – Hospital Cost Reports.

To access a CMS provided, standard template — select from the following.

- Medicare Bad Debts (Exhibit 2A) - Hospital 2552-10

- Medicaid Eligible Days (Exhibit 3A) - Hospital 2552-10

- Charity Care (Exhibit 3B) – Hospital 2552-10

- Total Bad Debt (Exhibit 3C) - Hospital 2552-10

Other provider types: RHC, CMHC, FQHC, ESRD & SNF

The following template for reporting Medicare Bad Debts is provided.

Note: The “Specification document” for each template is in the “Downloads” section of Electronic Cost Report Exhibit Templates.

Submit Cost Report

Providers are encouraged to file the cost report and all documentation through MCReF. If MCReF is not used, cost report can be mailed. However, do not submit through MCReF and mail a copy.

Please review the following in making a submission. And, ensure to include schedules or working papers for reclassifications, adjustments, related organizations, contracted therapists, and protested items.

Please note that all submitted cost reports are subject to a desk review and/or an audit.

MCReF

- All files are uploaded, including the electronic signature page

- Attach cost report files in their native format

- Bad debt lists should be sent in an Excel file format

Mailing

- Included a printed signature page so the cost report can be identified

- Ensure the cost report is signed (electronic signature is acceptable)

- If signing with a pen, use blue ink

- Place cost report files and supporting documents on a disk (or flash drive)

- Do not send printed copies of the cost report or documents

- If sending reports for multiple providers, clearly identify and place files on separate disks

- Attach cost report files in their native format

- Bad debt lists should be sent in an Excel file format

- Limit paper documents to only the signed, signature page (with encryption codes)

| Courier Service | U.S. Postal Service |

|---|---|

|

Palmetto GBA |

Palmetto GBA |

For cost reports sent through the mail, the date mailed is based on the U.S.P.S. postmark and not the date from a postage machine. If a U.S.P.S. postmark is not on the package, the receipt date will be used as the postmark date.

Medicare issues standard forms for the preparation of provider cost reports. These forms are available for viewing and reference in CMS Publication 15-2, The Provider Reimbursement Manual, Part 2. Below are links to forms by provider type. In opening the link, the form is indicated by an "f" at the end of the file name and the instruction with an "i."

|

Form |

Provider Type |

Latest Version |

|---|---|---|

|

CMS 287-05 |

Home Office Cost Statement |

|

|

CMS 2552-10 |

Hospital and Hospital Health Care Complex |

|

|

CMS 2540-10 |

Skilled Nursing Facility (SNF) |

|

|

CMS 265-11 |

End-Stage Renal Dialysis Facility (ESRD) |

|

|

CMS 224-14 |

Federally Qualified Health Center (FQHC) |

|

|

CMS 2088-17 |

Community Mental Health Center (CMHC) |

|

|

CMS 222-17 |

Rural Health Clinic (RHC) |

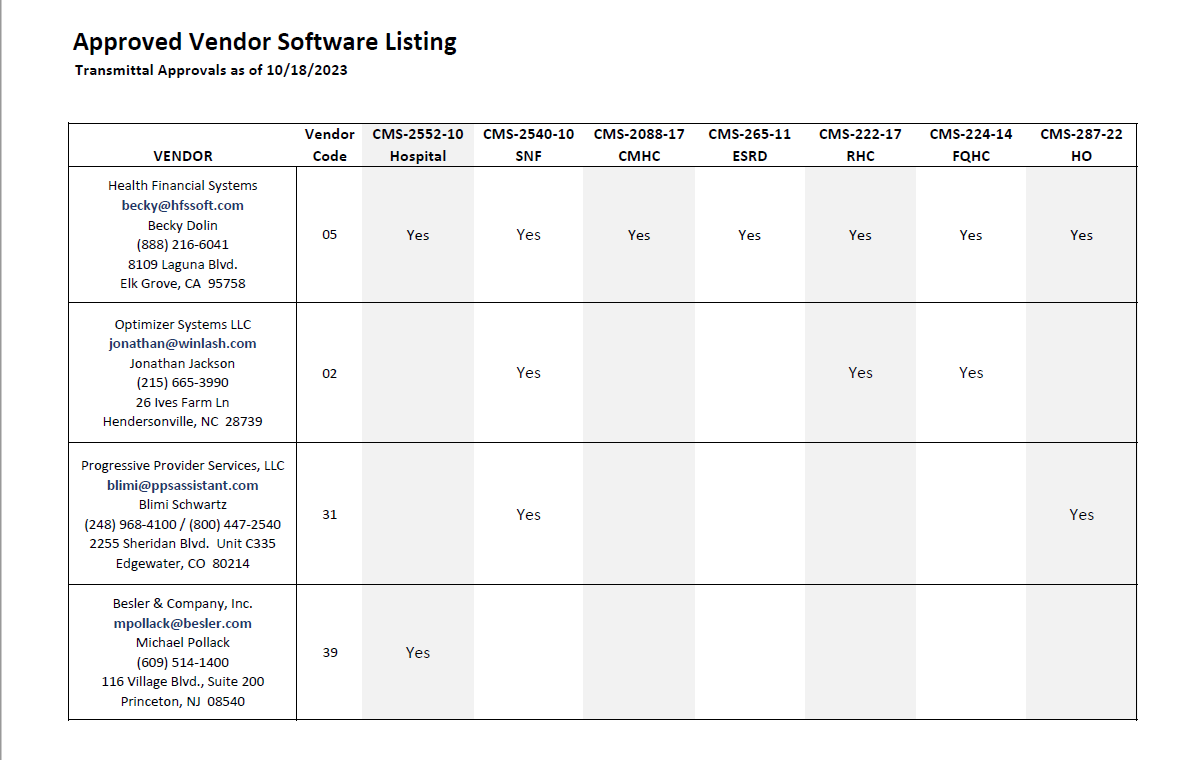

Medicare cost reports are prepared in an electronic format using software from a CMS approved vendor (see below). The electronic format consists of an Electronic Cost Report (ECR) file of the cost report and a Print Image (PI) file. Plus, a signature page with encryption codes that matches the ECR and PI files. The cost report can be signed with an electronic signature (with the exception of the Home Office form, CMS 287-05).

Electronic cost report filing is not required for these less than full cost reports. The documents can be mailed to the address noted above.

No Medicare Utilization — Submit a statement on the agency’s letterhead, signed by an authorized official, identifying the MCR period. This must state 1) no covered services were furnished during the reporting period, and 2) no claims for Medicare reimbursement will be filed for this reporting period. In addition, submit the signed worksheet S (certification page) of the MCR.

Low Medicare Utilization — An option if Medicare reimbursement is less than the following thresholds:

- Federally Qualified Health Clinic (FQHCs) = $50,000

- Rural Health Clinics (RHCs) = $50,000 Community Health Mental Health Clinics (CMHCs) = $15,000 (and no outlier payments reported on the PS&R)

- All other provider types (hospital, SNF, HHA, hospice, etc.) = $200,000

Submit the following: 1) page one of the applicable cost report form; 2) signed officer certification sheet; 3) balance sheet; and 4) statement of revenues and expenses.